Just when you thought you were safe from French Connection UK (known for some years now as fcuk), there is a trend identified by the New York Times of using swearwords in brand names - Eggslut restaurant, Holy Crap cereal, Fat Bastard wine, you know the kind of thing.

It seems to me that this may be the beginning of the end of the great branding phenomenon, which so excited the marketing world in the 1990s. We were told we would all love our brands, when the truth is we usually find them infuriating.

This is what I think is happening, as I explained on the Guardian's Comment is Free site today.

The delusions of the first decade of the century

The news that HMRC is preparing to sell our anonymised tax data has made me wonder a little at how we will remember this decade when it is over.

The news that HMRC is preparing to sell our anonymised tax data has made me wonder a little at how we will remember this decade when it is over.The reason I wonder is that, despite the launch of the Turing Institute - at least as a gleam in the Treasury's eye (and I'm sure my e-biography of Alan Turing was deeply influential here, especially now it reached #1 in one Amazon category last weekend!) - I'm not completely convinced that Big Data will really prove as important as we currently believe.

The reason is that it suffers from precisely the same weaknesses as any data. It gives the impression of hard numbers, evidence-based hardheadedness, objectivity and all that, but the numbers are also chained to definitions, and these are endlessly malleable.

The pursuit of Big Data is not going to be pointless, but it will be stuffed full of delusions - which won't be apparent until the decade of Big Data is well and truly over.

This thought has led me to have a think about the previous 'noughty' decade - the first decade of the twenty-first century - and the little delusions we used to tell ourselves. I've boiled these down in my head into three, and here they are:

Delusion #1. There is no need to make anything. The odd thing is that all our mainstream political parties bought into this delusion to some extent, that manufacturing was somehow below us in the UK - that we had somehow progressed beyond it. This was central tenet of the Treasury under Gordon Brown and Ed Balls, that financial services was the way we were going to specalise in the global marketplace - without realising that financial services was also the cuckoo in the nest: it eventually drives out everything else. Thanks to Vince Cable and others, UK manufacturing is slowly being clawed back. So that little delusion is, I think, over - even if we still haven't understood some of the practical implications for the kind of financial services we need. The current financial sector is wholly ineffective when it comes to providing for the capital needs of manufacturing.

Delusion #2. There is no such thing as geography. This was a delusion foisted on us by the internet and AI pioneers of the US West Coast. You couldn't be in any kind of policy meeting without someone saying something fatuous about 'online communities' being the future of community. A decade later, I think most of us realise that, if we believe our Facebook friend are our real friends, we are likely to face a lonely future. The truth is that geographical communities, awkward and authentic as they are, are the only effective ones, for most of us - though of course an occasional exchange online can't be a bad thing.

Delusion #3. Everything can be measured. This was the greatest delusion of them all - the quotation is taken from the ubiquitous management consultancy McKinsey - when the truth is that the really important things, from love to happiness, are wholly unmeasurable. This delusion still has many of us in its grip, and especially as we hurtle into the decade of Big Data, which suffers from the same kind of drawbacks.

Of course, in practice, these were also the delusions that were written into the New Labour years like the writing through a stick of rock, and this is where it matters that we are still in the grip of delusion #3. In practice, we subjected our services and voluntary sector funding to incisive questioning over their impact, asked them for evidence, and then handed the money over to institutions that were able to provide it.

It would be quite reasonable, were it not for two problems. A huge percentage of the time, energy, creativity and effort was shifted from making things happen to producing data, which was flawed. Of course it was flawed: people's jobs and livelihoods depended on it being good.

The second problem was that we handed services increasingly over the new outsourcing giants, because they were able to produce reliable data about their impact, and then sat back and breathed a sigh of relief.

It is slowly becoming clear, unfortunately, that the production of data was the only thing they could do. It was the sole purpose of those great outsourcing monsters, the central purpose of their design. It seems likely that they can produce the data, but can't actually have an impact - and this very distinction was what was being denied.

So we remain in the grip of at least one delusion of the previous decade. Here's to its speedy unmasking...

Learning about essential oils....

Hi y'all!! Long time no blog!!! :) I've been busy homeschooling and homekeeping and trying to learn more about essential oils!!!

I'd surely love to hear from anyone who uses essential oils by applying topically or by inhaling them or by capsule or in homemade cleaning products!! Share tips and please share what particular brand you've found to be the best and WHY.

A temporary hiatus

All good things must come to a temporary hiatus, and I'm afraid it is the same with this blog - for a little while. I'm working at the Guardian, in the Comment team, which is fascinating - and temporary - but I find I can't both blog and come up with ideas for everyone else at the same time.

I'm not going away completely. I'm already itching to write about a whole range of things, just from my last train journey past Battersea Park - and I will do. But I won't be appearing here quite so often.

But I'll be back later in the summer, if not before. Thanks so much for bearing with me, as you have in the past as well. See you soon.

I'm not going away completely. I'm already itching to write about a whole range of things, just from my last train journey past Battersea Park - and I will do. But I won't be appearing here quite so often.

But I'll be back later in the summer, if not before. Thanks so much for bearing with me, as you have in the past as well. See you soon.

Turing biography on special offer at 99p

This is rather a late acknowledgement of the government's recognition of the great computer pioneer Alan Turing in the budget. In short, they have set aside £42m for a university unit to study big data, and they are going to call it the Turing Institute.

This is rather a late acknowledgement of the government's recognition of the great computer pioneer Alan Turing in the budget. In short, they have set aside £42m for a university unit to study big data, and they are going to call it the Turing Institute.The announcement came just three months after Turing was given a royal pardon, rather belatedly, for his conviction for homosexuality in 1952 - which started the chain of events which led to his suicide two years later. And, yes, it was suicide.

It also comes just a few months before the release of the film about his code-breaking work at Bletchley Park, starring none other than Benedict Cumberbatch, who is beginning to corner the market in portraying genius.

There is clearly something in the ether about Turing at the moment.

Which is all to the good because my e-biography of him, Alan Turing: Unlocking the Enigma, is on special offer from tomorrow and for the rest of the week. You will be able to download it for 99p - which is pretty good for 20,000 words...

The new generation tower blocks are just as disastrous

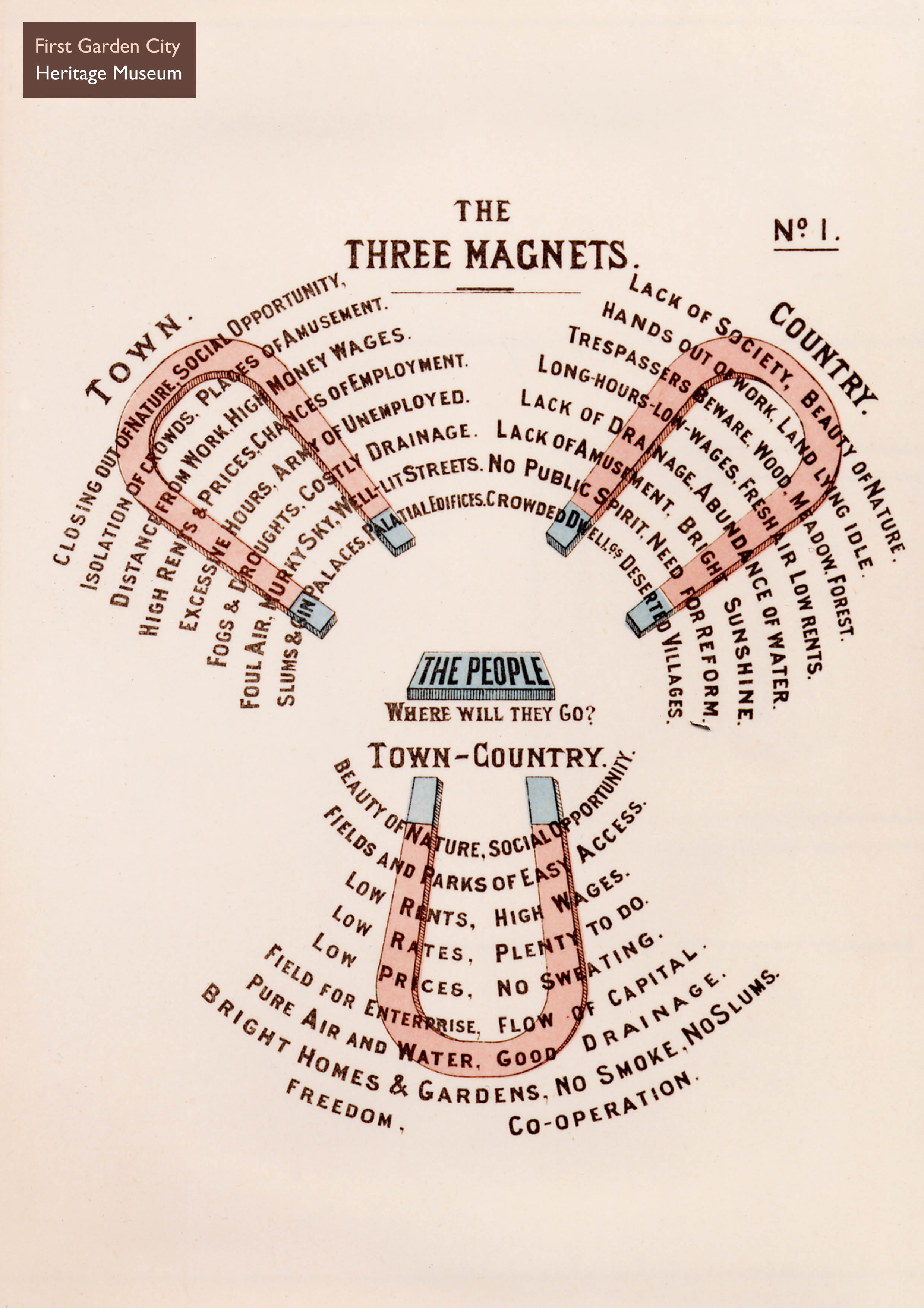

I am fascinated by the announcement of three new garden cities by the government yesterday. I'm aware that this was finessed by Nick Clegg in the teeth of opposition from some Conservatives who fear that their own constituencies will provide the sites.

I am fascinated by the announcement of three new garden cities by the government yesterday. I'm aware that this was finessed by Nick Clegg in the teeth of opposition from some Conservatives who fear that their own constituencies will provide the sites.After all, the fear of fear itself is quite enough when it comes to large scale developments.

The garden city idea, as almost everyone must know by now, was originated in 1898 by Ebenezer Howard to simultaneously stop the overcrowding and overheating of cities and to regenerate rural areas.

His ideas were backed by important sections of the Edwardian Liberal Party, especially those who were interested in co-housing and other kinds of mutual housing developments - because they were attracted to Howard's stipulation that the land beneath his garden city must stay in community ownership.

That, I fear, may be leap of imagination too far for the Treasury. And it's a pity, because separating the ownership of the land from the ownership of the buildings may be an important way that homes might be made more affordable.

That history is pretty familiar. The arguments that came later have largely been forgotten, but they are relevant today as well.

First, there was the great row of the first generation garden city enthusiasts with the proponents of 'garden suburbs', basically a clash between those who wanted freestanding developments to prevent unplanned city sprawl - and those who preferred the sprawl.

Second was the great row of the second generation garden city enthusiasts in the 1940s and 1950s with the modernist architects - and here Frederic Osborn (Howard's former assistant) found himself on the losing side.

He was largely beaten by an alliance between architects and conservationists, who believed that people should live in high density housing - preferably towers - to prevent damage to the countryside.

It was an alliance that was mirrored politically between the urban Labour boroughs who wanted to keep their voters in place, with the shire Tories who wanted to keep Labour voters out.

The result was the first, disastrous and destructive, generation of tower blocks. Still not paid for. Still offering an inhumane, rabbit hutch living to the poorest and least powerful.

Now we have the emergence of the second generation of tower blocks. These are just as badly planned (see the comments by the former London planner Peter Rees) but they are different. They are ponzi homes, for rich investors, designed to stay empty as they rise in value.

They are backed by the same alliance between architects and conservationists and for the same reason. But they are just as inhuman as the first generation, and they will have the same effect on the rest of us - they create wind, disorder and they belittle our humanity.

Subscribe to this blog on email; send me a message with the word blog/subscribe to dcboyle@gmail.com. If you want to stop, you can email me the word unsubscribe.

Something is emerging beyond conventional capitalism

The co-operative sector is having a tough time at the moment. Not because the 6,000 or so mutuals in this country are in any difficulties - quite the reverse - or even because the biggest and most impressive employee mutual in the country is failing to thrive.

On the contrary John Lewis and Waitrose are storming ahead. But there is no doubt that the Co-operative Bank (not actually a co-op at all, but owned by a co-op) is causing a sense of crisis for everyone else.

And because the bank is having a torrid time, its 30 per cent owners the Co-operative Group are in some disarray as well.

It has a hugely complicated democratic structure, the regulators are crawling all over the board, and the whole edifice has been funnelling money pointlessly to the Labour Party for years.

But to make matters worse, there is the business press urging them to adopt precisely the same dysfunctional structure as every other plc - a choice, as far as I can see, like the Devil and the Deep Blue Sea.

Lord Myners' proposals, as I understand it, are a potential middle way forward, at least as he explained it in the Guardian this morning.

I agreed with the long-standing co-operator Vivian Woodell in the radio last week, when he said that he thought the way forward for the Co-op would be to be more like a co-op not less like one. There is certainly no point in the Co-op at all if it is exactly like every other bog standard company in the UK.

So let's take a deep breath and a longer view, because there was a moment a century ago when the co-operative movement was poised to hold the line between conventional capitalism and state socialism, especially in housing.

Backed by Liberal politicians like Henry Vansittart Neale and Henry Vivian, there are records of over 8,600 homes built by co-partnership societies between 1901-12, and there are were 35 other societies whose records have been lost. Six are still in existence.

Vivian was MP for Birkenhead, an ally of Liberal reformers like George Cadbury and Joseph Rowntree who were determined to unleash a new kind of working class mutualism that could provide for people’s needs and fight the causes of poverty. The co-partnership societies had their own direct works departments, playing fields, club houses and garden parties – and lectures: this was the great age of the lantern slide.

The co-operative movement was just the tip of a burgeoning iceberg, and the engine of much else besides. Within weeks of the start of the First World War, the Co-operative Wholesale Society was turning out 10,000 tunics a day for the army and its ships were rescuing the survivors of torpedoed vessels.

On the contrary John Lewis and Waitrose are storming ahead. But there is no doubt that the Co-operative Bank (not actually a co-op at all, but owned by a co-op) is causing a sense of crisis for everyone else.

And because the bank is having a torrid time, its 30 per cent owners the Co-operative Group are in some disarray as well.

It has a hugely complicated democratic structure, the regulators are crawling all over the board, and the whole edifice has been funnelling money pointlessly to the Labour Party for years.

But to make matters worse, there is the business press urging them to adopt precisely the same dysfunctional structure as every other plc - a choice, as far as I can see, like the Devil and the Deep Blue Sea.

Lord Myners' proposals, as I understand it, are a potential middle way forward, at least as he explained it in the Guardian this morning.

I agreed with the long-standing co-operator Vivian Woodell in the radio last week, when he said that he thought the way forward for the Co-op would be to be more like a co-op not less like one. There is certainly no point in the Co-op at all if it is exactly like every other bog standard company in the UK.

So let's take a deep breath and a longer view, because there was a moment a century ago when the co-operative movement was poised to hold the line between conventional capitalism and state socialism, especially in housing.

Backed by Liberal politicians like Henry Vansittart Neale and Henry Vivian, there are records of over 8,600 homes built by co-partnership societies between 1901-12, and there are were 35 other societies whose records have been lost. Six are still in existence.

Vivian was MP for Birkenhead, an ally of Liberal reformers like George Cadbury and Joseph Rowntree who were determined to unleash a new kind of working class mutualism that could provide for people’s needs and fight the causes of poverty. The co-partnership societies had their own direct works departments, playing fields, club houses and garden parties – and lectures: this was the great age of the lantern slide.

The co-operative movement was just the tip of a burgeoning iceberg, and the engine of much else besides. Within weeks of the start of the First World War, the Co-operative Wholesale Society was turning out 10,000 tunics a day for the army and its ships were rescuing the survivors of torpedoed vessels.

But the co-op movement went head to head with the Fabians, which took a different view. The alliances between Liberal business leaders and working class institutions like consumer co-ops, which had been the route by which people like Vivian – a carpenter by profession – had reached parliament, began to look naïve.

Meanwhile, the co-operative movement was about to be bludgeoned out of existence by the new totalitarians across Europe. Fascists in Italy burned out co-operative stores. In Vienna, where half the population was supplied by consumer co-ops, the leaders were arrested within weeks of the Anschluss.

Meanwhile, the co-operative movement was about to be bludgeoned out of existence by the new totalitarians across Europe. Fascists in Italy burned out co-operative stores. In Vienna, where half the population was supplied by consumer co-ops, the leaders were arrested within weeks of the Anschluss.

In Russia, where the co-operative movement ran its own university and central bank, all co-op property was confiscated by the Bolsheviks. Only in Iceland and Scandinavia did mutualism survive on any scale.

By the 1930s, even George Orwell was parroting the Shavian ridicule of any radicalism that was not Fabian: “If only the sandals and pistachio-coloured shirts could be put in a pile and burnt,” he wrote in 1937, “and every vegetarian, teetotaller and creeping Jesus sent home to Welwyn Garden City to do his yoga exercises quietly."

Yet there is an emerging narrative in the USA that mutuals are once again the way forward, driving a Liberal wedge between conventional capitalism, which seems unable to meet our needs, and state socialism which has failed.

Watch this clip of Gar Alperovitz, one of the the interesting of the political commentators in the USA, with years in Washington behind him, talking about the new mutuals emerging in the stricken city of Cleveland, Ohio.

There is an unusual clarity about his vision, especially for these compromised days. "Capitalism is dying," he said. "But something a lot better is taking its place."

I also think he is right.

Subscribe to this blog on email; send me a message with the word blog/subscribe to dcboyle@gmail.com. If you want to stop, you can email me the word unsubscribe.

What happens to political parties in power

I was at an internal Liberal Democrat meeting at Westminster some weeks ago - I won't say which, but there was a minister there - and it made me think about the particular trauma of being in government, and the effect it has on people.

I was at an internal Liberal Democrat meeting at Westminster some weeks ago - I won't say which, but there was a minister there - and it made me think about the particular trauma of being in government, and the effect it has on people.There is, of course, something of an inevitable divide between parties at Westminster and parties campaigning locally. For the Lib Dems, this is exacerbated by the emergence of a new cadre of special advisers and party staff who might not even have been members before 2010.

I don't want to give away much about this conversation, because it wouldn't be fair. But what took my breath away was the gulf between parliamentarians in government (deeply pragmatic) and parliamentarians who still regard themselves as grassroots campaigners.

Most Lib Dems are both - they have to be - so this tends to be a psychological divide. It is a divide in the soul. And it set me thinking about what happens to political parties once they find themselves in government.

I have no evidence for these assertions, except my own eyes. But I have a feeling that the experience, and the pressure and frustrations, affect different ideologies differently.

For Conservatives, a few years in the mangle of government, and they come out deeply cross, perhaps even arrogant. Their fundamental sense of their own entitlement to power becomes more evident. They become beset at a deep level by rage that they are being questioned at all.

Often these transformations seem to me not only to bring out the shadow side but to be experienced as major irritation. For the Conservatives, the irritation is that they are being prevented - by the leadership, the coalition, the Eurocrats, the liberal establishment - from ruling as they see fit.

For Labour, the shadow side is different. They become micro-controllers, enraged at the failure of institutions and individuals on the ground to fall into line in the way they expected. They they become arch-centralisers.

Incidentally, this means that - while I'm delighted at Ed Miliband's recent campaign about setting the cities free - I remain slightly sceptical about the ability of a Labour government to see this through.

Which brings us to the Lib Dems. Their rage in government is directed at impractical idealists, those whose failure to be pragmatic enough - to fully understand the barriers to change - are preventing them making progress.

They become arch-pragmatists, prepared to accept almost any compromise if it avoids the humiliations of powerlessness that seem inevitably to come with power. Interested only in the specific path to making things happen.

That was the difficulty when Lib Dems ran so many local councils. The councillors in power tended to forget their ideological roots, and began to believe in good, pragmatic government, and consequently lost their compass and stopped innovating.

A little pragmatism isn't a bad thing. I've had a homeopathic dose of it on the very fringes of government, and feel it has done me good. I was, after all, one of those impractical idealists, deeply committed to vague change, the details of which eluded me.

But then, maybe that's what they all feel.

What do we do about it? I don't know, but a little self-knowledge can work wonders.

Subscribe to this blog on email; send me a message with the word blog/subscribe to dcboyle@gmail.com. If you want to stop, you can email me the word unsubscribe.

The secret history of money

I've been interested in the future of money for far too long, and fascinated why it is that so little attention is paid to the problem of where it actually comes from.

I've been interested in the future of money for far too long, and fascinated why it is that so little attention is paid to the problem of where it actually comes from.I don't mean 'wealth creation' and the other cliches of politics. I mean who actually creates the pounds and euros in the first place.

This is a particular blind spot for the English, who are deeply conservative about these things. I was assured some years ago by the Washington correspondent of one of our biggest newspapers that all money is based on gold (not the case since 1931). Admittedly, he was from the Sun, but even so - he ought to have known.

Even among the radical types interested in this kind of thing, it is all pretty obscure.

I remember six of us sitting down to lunch at Schumacher College, all of us with a background in green economics, complaining about the ignorance around the issue - only to discover that all six of us had been labouring under six different interpretations.

There are serious consequences for this. It means that, for most of the past century or so, the business of how money is created has been completely ignored by the mainstream, allowing the whole question to be infiltrated by cranks, racists and conspiracy theorists.

One of the first serious attempts to look at this question from the point of view of radical change was James Robertson and Joseph Huber's pamphlet in 2000 called Creating New Money.

It was published by the New Economics Foundation (full transparency: I'm a fellow), and it was there nearly four years ago that I was involved in a meeting - also including my colleagues Stewart Wallis, Josh Ryan-Collins and Tony Greenham - which decided to end this great divide once and for all.

The result was their very successful book, Where Does Money Come From?, which set out in academic style exactly the process that happens when money is created. It was a hugely important moment.

And even more important now that the Bank of England has ended their long silence on the issue and confirmed this interpretation:

"Most money in the modern economy is in the form of bank deposits, which are created by commercial banks themselves… When a bank makes a loan to one of its customers it simply credits the customer’s account with a higher deposit balance. At that instant, new money is created…”

This is important (though it's also a few weeks old - I've been meaning to write this post for ages). It means that the old pretence that somehow money creation remained directly in the hands of governments, or was based on gold, or that all money simply goes round and round like the London water supply, is finally now over.

Now this is finally in black and white, then some of the implications need to be addressed. Most money is created with interest attached - it has to be paid back, plus a bit. It has inflation built into it. It is also stretchable, especially if you are already wealthy (for most of us, it remains concrete and unforgiving, of course).

But the most important area now opened up for discussion is this. Given that money was not made by God on Day Six of the creation of the world, is there another way of providing ourselves with our monetary needs more effectively and with less built-in instability? Are there other kinds of money we might invent as well?

Normally I would say at this point something silly like 'I think we should be told'. But it is time we stopped being told these issues were too complicated for us. I think, instead, we should discuss - and as widely as possible.

And if you're interested in the history of this debate, may I recommend that you start with my book The Money Changers.

Subscribe to this blog on email; send me a message with the word blog subscribe to dcboyle@gmail.com. If you want to stop, you can email me the word unsubscribe.

The next financial crash

Financial regulators have to be adept at shutting the stable door after the horse has bolted – and especially so in England, where decades are usually required to persuade politicians that the horse has left the stable at all.

Minute examination of its straw continues for some time while everyone else can see the animal rampaging round outside, seeking whom it will devour.

The problem is that the English, as I may have mentioned before – and it is the English not the Scots – are a deeply conservative breed when it comes to money.

They also have a blind spot about it – they still believe things are exactly the same as they were in the 1950s, with Captain Mainwaring at his desk dispensing sherry, when he has long since been pensioned off in favour of risk software at regional office.

Take share trading for example. The English still believe, along with other economic fundamentalists in the USA, that markets will always create an accurate price. This is the Efficient Market Hypthesis by Chicago economist Eugene Fama.

Fama and his colleagues came up with the idea in 1970 but recent events have shown that it is almost certainly wrong, and disastrously so. Or so you would have thought.

It doesn’t help that most of thinking about the financial markets which now dominate the world is done behind closed doors. But there are a few thinktanks which now specialise in it – the Institute for Market Dysfunctionality at the LSE is one. The Capital Institute in New York is another.

Both were founded by people with successful careers in the financial markets. John Fullerton at the Capital Institute had 18 years at J. P. Morgan.

So I take his warnings seriously. When he says that algorithmic trading threatens the stability of the global economy, you have to listen. This is what he said:

“Scientists understand that, in any given system, there is a need to balance system efficiency (resulting in high throughput) with system resilience (resulting in an ability to withstand shocks). Yet in the case of financial markets, the balance has tipped too far in favor of speed and perceived efficiency, leaving markets highly brittle and more susceptible to collapse. High degrees of financial leverage compound this, leaving them vulnerable to events like the 2008 financial crisis and the numerous mini-crashes that have occurred since and are continuing…”

Unfortunately, the regulatory system in the UK tends to be busy fighting the last war and congratulating itself on its success in preventing it, without realising that something very different is on the cards.

But don’t let’s pre-judge the new arrangements which have just come into effect. The coalition has taken financial regulation seriously and have a different approach to it, so there is hope.

But it matters, for example, that nobody is at the controls of the giant trading machine. It matters that the combination of algorithmic trading on a huge scale, and the trading of obscure derivatives, can plunge us into a darkness on a scale way beyond the banking crash of 2008.

It matters that people like Fullerton can see us accelerating towards the next financial crisis far faster than usual.

This is a key question for whoever forms the next government in the UK. It needs to be very high up in the rival manifestos – both how to prevent the looming crash (a financial transactions tax, as Fullerton suggests) and how to deal with it once it has happened (creating the money to pay of the unrepayable debt hole perhaps).

But will it be? Unfortunately, we are still in the process of minutely examining the straw in the stable...

This post is adapted from ones cross-posted at New Banking UK and the New Weather Institute.

So I take his warnings seriously. When he says that algorithmic trading threatens the stability of the global economy, you have to listen. This is what he said:

“Scientists understand that, in any given system, there is a need to balance system efficiency (resulting in high throughput) with system resilience (resulting in an ability to withstand shocks). Yet in the case of financial markets, the balance has tipped too far in favor of speed and perceived efficiency, leaving markets highly brittle and more susceptible to collapse. High degrees of financial leverage compound this, leaving them vulnerable to events like the 2008 financial crisis and the numerous mini-crashes that have occurred since and are continuing…”

Unfortunately, the regulatory system in the UK tends to be busy fighting the last war and congratulating itself on its success in preventing it, without realising that something very different is on the cards.

But don’t let’s pre-judge the new arrangements which have just come into effect. The coalition has taken financial regulation seriously and have a different approach to it, so there is hope.

But it matters, for example, that nobody is at the controls of the giant trading machine. It matters that the combination of algorithmic trading on a huge scale, and the trading of obscure derivatives, can plunge us into a darkness on a scale way beyond the banking crash of 2008.

It matters that people like Fullerton can see us accelerating towards the next financial crisis far faster than usual.

This is a key question for whoever forms the next government in the UK. It needs to be very high up in the rival manifestos – both how to prevent the looming crash (a financial transactions tax, as Fullerton suggests) and how to deal with it once it has happened (creating the money to pay of the unrepayable debt hole perhaps).

But will it be? Unfortunately, we are still in the process of minutely examining the straw in the stable...

This post is adapted from ones cross-posted at New Banking UK and the New Weather Institute.

Subscribe to this blog on email; send me a message with the word blog subscribe to dcboyle@gmail.com. When you want to stop, you can email me the word unsubscribe.

Miliband: my part in his policy development

I met Ed Miliband only once, some years ago, to talk about co-production. I'm not aware that he has ever read my book about the middle classes (Broke: How to Survive the Middle Class Crisis). I've certainly never been contacted by his office.

Yet clearly there is some link, because he appears to be running with the agenda I set out there.

This is a peculiar feeling. I never imagined that it would be the Labour Party which responded to this , just as I never expected that the one major company to take up the ideas in my book Authenticity would be McDonald's, of all people.

But there is no doubt in my mind that Miliband is right to focus on the middle class crisis - not because the middle classes are the only ones to suffer from the economic dispensation shaped in the Thatcher-to-Brown years. Quite the reverse. But because this is not a crisis that's going to be solved just with welfare payments for the poorest. It needs something more fundamental.

The problem is that his prescription seems, on a cursory glance - all you really get in his article in The Independent yesterday - somewhat empty.

There is the cost-of-living crisis, which is vaguely identified by Miliband's office as something to do with market concentration. He's right, but it isn't clear why he wants to have a Big Six banks when he also says the Big Six energy companies need breaking up.

There is the cost of housing, which is again portrayed in very vague terms. If you really want to hear about the emerging tyranny of the housing market, the way it is even now concentrating economic power and ambition in the hands of the wealthiest, you might be better listening to Vince Cable.

And there is his solution: making cities "engines of growth" by devolving economic power. Again, this is right but terribly vague.

So we have some way to go before I will be at all convinced that Miliband or his party either understand the middle class crisis, or have any intention of doing anything about it.

Where he is right is to ignore completely the obfuscation around this issue thrown up by the research by the Social Market Foundation, which claims to show that the middle classes have done alright over the four years from 2008-12.

This isn't very convincing. They show that two fifths of their research base had gone up to the next income bracket in that time, and show how adaptable they were - when their average income fell during the period by 13 per cent.

Some of the middle classes do manage to rise, after all - that is what their mortgages demand of them. That is what they have to do if they are ever to move off interest-only mortgages. But two-fifths is not very many.

In any case, the real middle class crisis is not for those who are getting by now - it is for their children. They are the ones who will face average house prices of £1.2m in three decades time (if house prices rise like they did in the last 30 years) and find themselves wholly dependent on the whims and prices of Big Landlord.

So Miliband is right. This is not just important stuff now; it goes to the heart of the monster we have created over the past 30 years.

But tell me, Ed, exactly what are you planning to do about it so that my children can have somewhere to live which doesn't fling them into indentured servitude?

Here's one suggestion. Read Broke, if you haven't already, and you could find out.

Subscribe to this blog on email; send me a message with the word

blog subscribe to dcboyle@gmail.com. When you want to stop, you can email me the word unsubscribe.

The real meaning of the Orange Book

It is a worrying fact, for those of us who would prefer to stay the age we are, that The Orange Book is now ten years old. Centre Forum is organising an essay competition to celebrate - and the opportunity has been grasped by some academics to draw some rather strange conclusions.

It is a worrying fact, for those of us who would prefer to stay the age we are, that The Orange Book is now ten years old. Centre Forum is organising an essay competition to celebrate - and the opportunity has been grasped by some academics to draw some rather strange conclusions.One of these is Peter Sloman, who has written an interesting piece on the LSE politics blog (thank you, Simon). It is interesting enough to be half right - but falls a bit flat with this wholly unsupported assumption:

"That the party has moved rightward in the decade since The Orange Book can hardly be doubted – the very existence of the coalition is testimony to that..."

On the contrary, I think it can be doubted. In fact, I doubt it very much. The assumption here is that the coalition with the Conservatives was somehow a policy choice by the Lib Dems, when most sources confirm it was a matter of electoral arithmetic.

I can see the argument that the coalition might have driven a rightward shift - though I dispute that too - but not that it is evidence of a shift that existed before.

The peculiar thing is that The Orange Book has gone into political mythology along these lines, and it is hard to extract it again. Still, I just extracted my copy from my bookshelf, reminded myself that the subtitle was 'Reclaiming Liberalism', and took a second look.

It is obvious opening it again, blowing the dust off, that the Liberalism that is being 'reclaimed' is not just economic liberalism, but social and political liberalism too. It is clear from a quick read that what the book was reacting to, apart from the Blair government, was to a particularly bland period of Lib Dem policy-making.

The essays in the book, by people on the left as well as the right of the party, seem now to have been tentatively testing out new Liberal positions. Some of them (abolishing the DTI, national health insurance) are obviously rightward, some of them (Mark Oaten on an education revolution in prison) are clearly not.

But this isn't quite the end of the conversation. There is no doubt that the economic liberalism muscles were particularly exercised in the book, and this was the framing that David Laws gave the opening essay too.

Yet, even here, things look different to the myth. It is more about Liberalism gargling a little with economics, their traditional blind spot, taking a few ideas out for an experimental walk, waking their economic bones up after years of lazy inactivity.

Ten years on, Laws' essay looks like the beginning of the re-interpretation of economic liberalism that we still so badly need - neoliberalism is, in comparison, a kind of protectionism for the biggest and most powerful.

Ten years on, Laws' essay looks like the beginning of the re-interpretation of economic liberalism that we still so badly need - neoliberalism is, in comparison, a kind of protectionism for the biggest and most powerful.

So, no, I don't think that Peter Sloman's characterisation ("progressive yet anti-statist") is anything new. It was there in Chris Huhne's 2002 commission on public services (the emphasis on mutualism). It was certainly there in Jo Grimond's revived Liberalism.

But there is still something nagging away at me about this, and it makes me keep going back to the Sloman article. I think it is this: I don't believe the coalition is evidence of a rightward shift in the Lib Dems - though they have had to swallow their opposition to a number of compromises that will potentially haunt them.

But I was staggered that the coalition was agreed so easily, and surprised at my own excitement at the prospect of going into government with Cameron rather than Brown.

For me, I was so angry at the time with the Blair-Brown government for what seemed to me to be the destruction, at great expense, of the effectiveness of our public services. The iron targets, processes, standards and inspection, and the great hollowing out of our institutions that resulted.

In fact, the coalition failed to articulate this issue clearly. But for me it was a clincher. For me, at least, it wasn't a rightward shift, it was the urgent importance of rolling back New Labour.

Subscribe to this blog on email; send me a message with the word blog subscribe to dcboyle@gmail.com. When you want to stop, you can email me the word unsubscribe.

The great paradox of emotion in politics

I wrote yesterday about the great paradox of emotion in politics. It makes the English uncomfortable, as emotion tends to wherever they encounter it. I'm beginning to feel nervous even writing this, but then I am - above all - English.

Here is the conundrum, as it was played out in the second Clegg-Farage debate.

Nick Clegg's team let it be known that their man was going to be "more emotional" during the second clash, and he was - and it was effective. Farage was less emotional, but more able to connect his message to the gut emotions of the audience.

The problem is this. People don't want politicians to be emotional, though they prefer it to being to cerebral or turning into machine-like purveyors of statistics (and Clegg isn't either of those). But they do respond when politicians appeal effectively to their own gut emotions.

This is not about just talking about 'your jobs', which sounds slightly patronising. It means playing effectively to the deep values of the people listening, and Farage is adept at that.

English politicians are not just bad at displaying emotions - which is perhaps just as well (I don't think I could have watched Farage emoting) - they are also bad at appealing to emotions. It smacks of demagoguery. But unless they think about it, unless they are aware of the whole gamut of values held by their audience at a deep level, they will always lose out to the demagogues.

It is a case of William Booth's great maxim: Why should the devil have all the best tunes?

Or to put it another way: Why should Farage be allowed to portray himself as the only patriot in the room? Do our great traditions of tolerance count for nothing? What about the way the British have deliberately involved ourselves in Europe to prevent tyranny - not once, but over and over again?

My friend and colleague Joe Zammit-Lucia, with whom I discussed all this after the debate on Wednesday night, has written this on Huffington Post. It is a highly effective riposte to Farage's populism.

This seems to me to be one example of how the forces of light are letting Farage get away with it. He is being allowed to play tunes that they appear to be too proud, too cerebral or too ignorant of history to be able to play.

Subscribe to this blog on email; send me a message with the word blog subscribe todcboyle@gmail.com. When you want to stop, you can email me the word unsubscribe.

Here is the conundrum, as it was played out in the second Clegg-Farage debate.

Nick Clegg's team let it be known that their man was going to be "more emotional" during the second clash, and he was - and it was effective. Farage was less emotional, but more able to connect his message to the gut emotions of the audience.

The problem is this. People don't want politicians to be emotional, though they prefer it to being to cerebral or turning into machine-like purveyors of statistics (and Clegg isn't either of those). But they do respond when politicians appeal effectively to their own gut emotions.

This is not about just talking about 'your jobs', which sounds slightly patronising. It means playing effectively to the deep values of the people listening, and Farage is adept at that.

English politicians are not just bad at displaying emotions - which is perhaps just as well (I don't think I could have watched Farage emoting) - they are also bad at appealing to emotions. It smacks of demagoguery. But unless they think about it, unless they are aware of the whole gamut of values held by their audience at a deep level, they will always lose out to the demagogues.

It is a case of William Booth's great maxim: Why should the devil have all the best tunes?

Or to put it another way: Why should Farage be allowed to portray himself as the only patriot in the room? Do our great traditions of tolerance count for nothing? What about the way the British have deliberately involved ourselves in Europe to prevent tyranny - not once, but over and over again?

My friend and colleague Joe Zammit-Lucia, with whom I discussed all this after the debate on Wednesday night, has written this on Huffington Post. It is a highly effective riposte to Farage's populism.

This seems to me to be one example of how the forces of light are letting Farage get away with it. He is being allowed to play tunes that they appear to be too proud, too cerebral or too ignorant of history to be able to play.

Subscribe to this blog on email; send me a message with the word blog subscribe todcboyle@gmail.com. When you want to stop, you can email me the word unsubscribe.

Why Farage won

I was giving a presentation on choice in the NHS last night (thank you, Darzi alumni fellows) between the crucial hours of 7 and 8 in the evening, so I have had to watch the Clegg-Farage clash this morning – or as much of it as I could.

I was giving a presentation on choice in the NHS last night (thank you, Darzi alumni fellows) between the crucial hours of 7 and 8 in the evening, so I have had to watch the Clegg-Farage clash this morning – or as much of it as I could.My impression was very different to the polls which have handed the victory so spectacularly to Farage.

I thought that Clegg was effective, articulate, passionate and authentic. He took on Farage’s populism in a way that neither Cameron nor Miliband would have been able to do. It was a ferocious performance and an important moment, I thought, in our political history.

But the polls are not to be ignored, which means that the important moment may also be a worrying moment for the nation.

It is also tremendously important, for the forces of light, that we can be as honest as possible about why Farage was widely seen to have won, and I have three thoughts about this.

Thought #1. Clegg was emotional, but Farage was emotionally connected.

There was a controlled leak from the Clegg camp in the Guardian before the second debate which suggested that Clegg was going to be “more emotional”. He was, and it was effective. The trouble was, that wasn’t precisely what was required.

What Farage managed to do was not to be emotional – a scary prospect – but to draw on the emotions of those watching in his arguments. He was able to appeal to gut emotions and gut values in the way that Drew Westen showed that George W. Bush managed to against Al Gore’s statistics in his book The Political Brain.

It isn’t emotions in the politicians that we need; it is their ability to conjure emotional commitment in the voters. That is a very different matter and, as far as I can see, Clegg’s party has given very little thought to it.

Worse, all three of the big Westminster parties regard this sort of consideration with lofty disdain, bordering on fear, as if any involvement of the emotions in the electorate will conjure up the Gordon Riots all over again.

Thought #2. Farage has the time to think; Clegg doesn’t

The irony is that Clegg is precisely the kind of gut politician who is capable of doing this, but he suffers from a major disadvantage now. He is deputy prime minister. He is imprisoned in the system in 70 Whitehall where he is given no time to think for himself.

His every moment is concerned with detail and immediate response and he has surrounded himself with brilliant people who are extremely good at helping him with these immediate problems. But when it comes to drawing on new thinking, outside the prevailing and – let’s face it – rather tired and therefore vulnerable assumptions of the establishment, he has had to put it off for the last four years.

He is forced to draw on the old arguments, the assumptions that trade negotiations will result in widespread jobs and well-being, for example – which a dwindling number of us believe – because he exists in a Whitehall bubble that starves his creativity. Farage doesn’t. It puts him at a major advantage.

Thought #3. If Farage is allowed to be the only outsider, he will win.

Farage has shifted his position. He is now explicitly against “big business”, though it is hard to see anything substantive which he has ever said on the subject. But this is a significant widening of his message

If that means the banking scandal, the Libor scandal, the scandal of executive pay, and the way the manipulation of the world’s economic system in favour of a tiny elite has failed to trickle down – then so am I. So is nearly everyone.

Farage has realised how the barrage of statistics used by the establishment to defend EU membership, and the union with Scotland come to that, alienates as much as it enlightens. We know, after all, the limits of their applicability.

Let’s be personal about this. I have been a Liberal since 1979. I absolutely deny that this makes me some kind of insider or beneficiary.

I deny that Lib Dems in government, and Nick Clegg in particular, are Whitehall insiders. Quite the reverse, every step forward is an exhausting struggle against vested interests. I deny that the progress the party has made in government means we now have to defend the status quo.

As a Lib Dem, I don’t have to defend the lazy short-termism of the biggest businesses. I don’t have to pretend that backing enterprise means backing multi-million pound salaries for those who corrode the economy. I don’t have to defend the status quo, and – if I try to – I will lose the debate.

There is a clue here. If Liberals are able to see the world clearly, how the economic structures funnel wealth upwards, then we will sound like populists. But it is right that we should, but Liberal populists.

The difficulty is that it is hard to construct a new political language which is both tolerant and internationalist – but also furious at the way the world is currently arranged. That does not advertise our intention to tinker, but proclaims our determination to reform.

But that is what we have to do.

Clegg was quite right when he said that, as a nation, we are better when we are open-minded and work with other countries and peoples. That had resonance but it isn’t enough to win. Nor was the revelation that Farage wants to dig up the north of England for fracking.

And the next generation depends on us winning.

Why Hullcoin is so irritating, and other adventures in a multi-currency world

For getting on for two decades now, I’ve been predicting a multiple currency world and multiple currency lives.

For getting on for two decades now, I’ve been predicting a multiple currency world and multiple currency lives.There is evidence here and there – euros in phone boxes, the rise of local currencies – but, generally speaking, it steadfastly refuses to happen. Though I’m still convinced that it will.

It doesn’t help that I happen to live in the most boneheadedly conservative nation on earth when it comes to thinking about money. Most English people seem to feel it was created by God around Day Six of the Genesis and hasn't changed much since.

Then along came bitcoin. It was clear evidence that I had been on the right track, but I’m afraid I found it almost as irritating as it did before.

Not only is bitcoin doomed to be an inflationary speculative flash in the pan (I humbly submit) but its origins and structure and means of creation are the very opposite of transparent. Its inventor remains secret, for goodness sake.

But most irritating of all, it seems to have prodded a whole rage of misunderstandings to emerge, and there was another one on Monday in the Daily Telegraph, which I've just been shown (thanks, Jock).

It says that Hull City Council has started ‘mining’ their own digital currency in order to pay to volunteers, on the grounds that HMRC doesn't recognise digital currencies until they get converted into cash.

It is quite difficult to know where to start on this one, but let's have a go.

1. It isn't true that HMRC doesn't recognise digital currencies. For years, they have reserved the right to tax air miles and a range of other local currencies, if they are a major source of income. In fact, the Fininish government began taxing time credits to volunteers last September.

2. There are already very successful means of paying volunteers, in the form of time banks and time credits operating all over the country without the need to resort to complex 'mining'.

3. Paying volunteers is anyway a ticklish business. You have to make sure that it doesn't dampen their basic altruistic motivation, which means that credits need to be mere recognition of people’s efforts, and in no way exchangeable for any other kind of cash - because that would undermine their motivation in the medium term.

4. Hullcoin will find that the existing tax and benefits regulations apply to them, which means that – if their currency just recognises volunteering – then earnings will not be subject to tax and benefits, unless they are used to buy goods and except in the case of incapacity benefit. Nothing to do with digital disregarding digital money.

5. In fact, it comes under the EU e-money directive, and has done for years.

This is irritating partly because it is another example of a local authority which seems not to have asked advice before getting involved in new kinds of money (Isle of Wight County Council was prosecuted in 1997 for minting its own ecu coins).

I might be wrong: the Telegraph report might be wholly inaccurate.

But it is mainly irritating because it encourages the fantasy that some digital currencies are an unregulated area, a virgin territory ripe for exploitation.

My fear is that this will encourage the great Napoleonic controllers (Bank de France, Bundesbank spring to mind) to clamp down on what is a vital area of innovation: new kinds of money.

Because there is no area of modern life where we need innovative thinking than in money, and there is a long way to go. Where we are heading is unknown but I would be prepared to lay a bet that bitcoin will not be there.

Truancy, slavery and private peonage

I am therefore on the receiving end of a number of rather patronising and threatening letters from my children's school, warning me how much I might be fined for taking them out without permission.

Of course, I'm not in favour of parents just taking children out of school on a whim. I know, I know, school is important. My children need their education and - even more important - the school needs to meet their attendance targets. I know what's what.

What I find unacceptable is that, by tying parents to the school term dates in such a draconian way, they fling us into the embrace of the travel companies - who have no compunction about the massive hike in their prices during the school holidays.

This is fine if you can afford it, but if you can't - and most of us can't - then there is a kind of licensed extraction involved.

It has set me thinking about the way governments lend their authority to companies that want to rake money in from us.

There is a long tradition of this kind of thing. The Romans, Columbus and the Conquistadores and the British in India all forced the discipline of working hours on their new subjects by taxing them - so that they had to work to earn the money.

This is a form of slavery, and - although I'm not accusing the education authorities of enslaving parents - it is a related form of abuse.

It is related also to the way that local authorities used to hand us over to the tender mercies of private clampers, allowed to extract almost whatever they liked. This was also a kind of licensed extortion, and I'm not sure that forcing parents into the higher price brackets - allowing the travel industry to put a premium on fares outside term-time - is that different.

But the reason I've been thinking along these lines is that I have just read the most terrifying article in the American magazine The Nation, about an extreme version of this phenomenon. It involves handing over poor people accused of minor offences to private companies, who then charge them for their own imprisonment and probation.

They charge them so much, in fact, that they can never pay off the debts. It is a kind of peonage and, although the abuses by a probation company called JCS in Harpersville, Alabama, have been struck down by a local judge (he called it a "judicially sanctioned extortion racket"), similar abuses are going on in other parts of the USA.

This is how the article ends:

"Meanwhile, even as the Harpersville case wound its way through the courts, a prison healthcare corporation called Correctional Healthcare Companies bought JCS, allowing its new parent company to expand into the supervision and enforcement industry. And six months after Judge Harrington’s ruling, GTCR, a Chicago-based private equity firm, bought Correctional Healthcare Companies, including its wholly owned subsidiary JCS. It was a sign that the finance world believed criminal justice would remain good business..."

It is also a sign that the new kind of narrow efficiency practiced by the finance and private equity companies is quite happy to involve peonage if the option is open to them.

But this isn't just about privatised services; the link between state schools and travel costs is another example of the state holding us down while someone - public or private - rifles our pockets.

It is now a century since Hilaire Belloc and G. K. Chesterton claimed that both capitalism and socialism would tend towards slavery. It increasingly looks as though they were right.

Subscribe to:

Posts (Atom)